If your Projectworks environment is integrated with Xero or QuickBooks, you can export your reimbursable expenses as a bill to pay, so that the finance team can reimburse the employee.

An expense can be exported by a User who has the Access Level to Export Expense Claims if the expense is reimbursable (has been paid for with my own money).

Expenses must be enabled and mapped to the accounting system in Projectworks to allow expenses to be exported it. The following Expenses Settings must all be mapped to the correct values in the integrated accounting system:

-

Tax Types

-

Cost GL Code

Go to : Settings > Integration > Accounting > Expenses

Your accounting system administrator may be required to update your accounting system to enable and map tax types and cost GL codes.

Read more about how to integrate and map to an accounting system →

Exporting expenses for an employee for the first time

Exporting expenses to Xero

The employee who raised the expense is automatically created in Xero as a supplier the first time you export an expense for them.

Exporting expenses to QuickBooks

The employee who raised the expense is automatically created in QuickBooks as a vendor or supplier the first time you export an expense for them.

If multicurrency is set up in your version or QuickBooks, the vendor or supplier's currency will be set up in the currency that the person who has raised the expense is paid in.

Viewing exported expenses in the accounting system

Once a reimbursable expense has been exported, this will be able to be viewed and actioned in the accounting system.

-

Xero go to: Business > Bills to pay

-

QuickBooks

-

In Accountant view go to Expenses (Type = Bill)

-

In Business view got to Bookkeeping > Transactions > Expenses (Type = Bill)

-

If the reimbursable Projectworks expense has been marked as ‘Billable to customer (contributes to revenue)', this information will not be exported to Xero or QuickBooks.

Troubleshooting

Export to Xero or QuickBooks is not available for a selected Approved Expense

There a few reasons the export option might not be available:

-

-

-

The user does not have permission to export expense claims;

-

The expense integration has been enabled for the accounting system organisation; or

-

The person the expense claim has been raised against is posted to a Projectworks organisation that is not mapped to an accounting system.

-

-

A single instance of an Accounting System can be mapped to one or more organisations in the Projectworks instance.

Enable expense integration

Unlike invoicing integration, the expense integration must be enabled.

A Projectworks administrator can enable the expense integration and map the Tax Types (if applicable) and Cost GL Codes.

Go to: Settings > Integration > Accounting > Expenses

Read more about how to integrate to an accounting system →

-png.png)

Update person’s posting

A person must have an active posting to a Projectworks organisation that is integrated to an accounting system to enable their expense to be exported.

A Projectworks administrator can edit a person’s posting if it has been incorrectly set up, or create a new posting if that person’s circumstances have changed, e.g. they have relocated form New Zealand to Australia, and their terms of employment have changed.

To add or edit a person’s posting go to: Person > Postings >Edit this posting

Read more about adding a new posting →

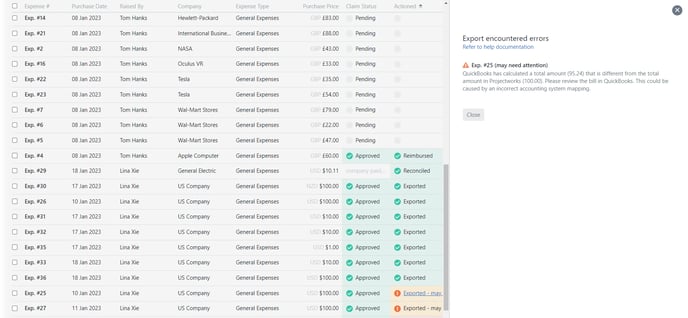

Expenses that have been exported, but may need attention

In the event that Projectworks has calculated an FX rate differently to your accounting system, a warning message will be displayed, so that this can be actioned as required.

Expense export failed

In most instances export failed errors will be caused by accounting system Expenses mapping errors. A Projectworks administrator will need to update the Expenses mapping to enable successful export of expenses to the connected accounting system.

Read more about how to integrate and map to an accounting system →

If an error occurs when exporting an expense, the error will be displayed. To redisplay the error:

-

Go to any of the screens where the expenses are displayed;

-

If the Exported column is not displayed, select “Exported” in the Hide/ show/ group filter;

-

Click on the “Export failed” hyperlink against the expense that you would like to know the export failure reason for.

Read more about troubleshooting common expense exporting errors →

Exported expense needs to be edited or deleted

Once exported an expense will be locked. If an expense has been exported in error, or it’s details need changing, it is possible to make amendments after the fact.

How to edit or delete exported expenses →

No QuickBooks vendor/ supplier matches the user’s email address

The person who raised the expense must be set up in QuickBooks as a vendor or supplier.

Currently adding a vendor/ supplier is not automatically created when an expense is exported to QuickBooks, so will need to be manually added.

When adding a vendor / supplier to QuickBooks, if multicurrency is set up for QuickBooks, ensure that the vendor / suppliers currency matches the currency that the person who has raised the expense is paid in.

If the currencies do not match, a new vendor/ supplier will need to be added in QuickBooks.

The person is now paid in a different currency

In the event that the person’s posting has changed, and they are reimbursed in a currency that they are not set up with in QuickBooks, an error will be invoked and an administrator will need to make changes in both Projectworks and QuickBooks to enable the expense to be exported.

Read more about troubleshooting common expense exporting errors →