If you have inadvertently over-invoiced a client, you may need to raise a credit or a credit note.

Raising a credit or a credit note will ensure:

-

Your client is invoiced the correct amount;

-

And that the revenue, margin and outstanding WIP for the project are not over-inflated.

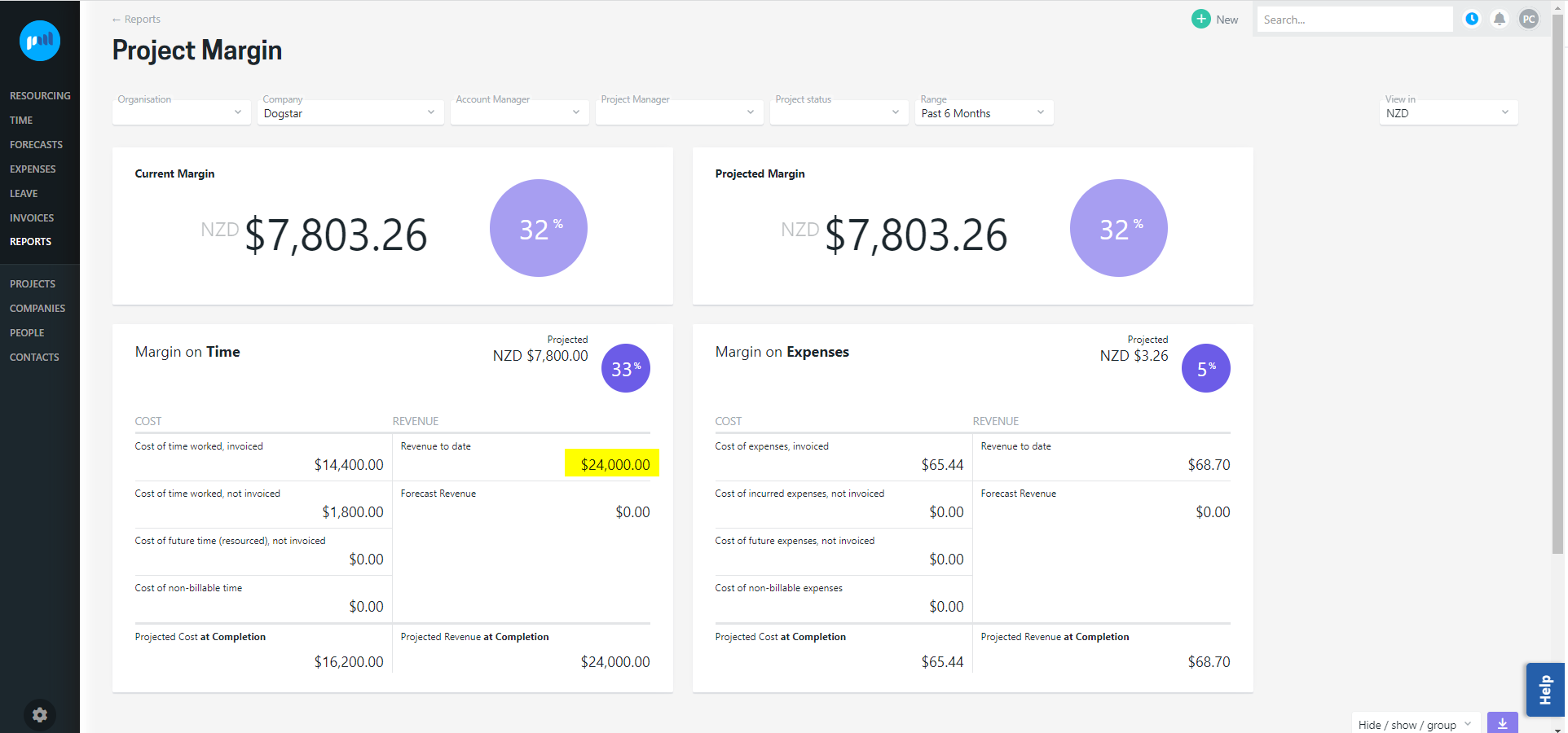

e.g.

Client 123’s contract for work includes agreement for:

-

2 resources to work 40 hours a week on Project A at a rate of $100 p.h.

-

Milage or public transport to and from site visits (excludes parking)

Billy Bob is new to the organisation and has been working overtime on Project A as he comes up to speed, and logging 50 hours a week against Project A in Projectworks.

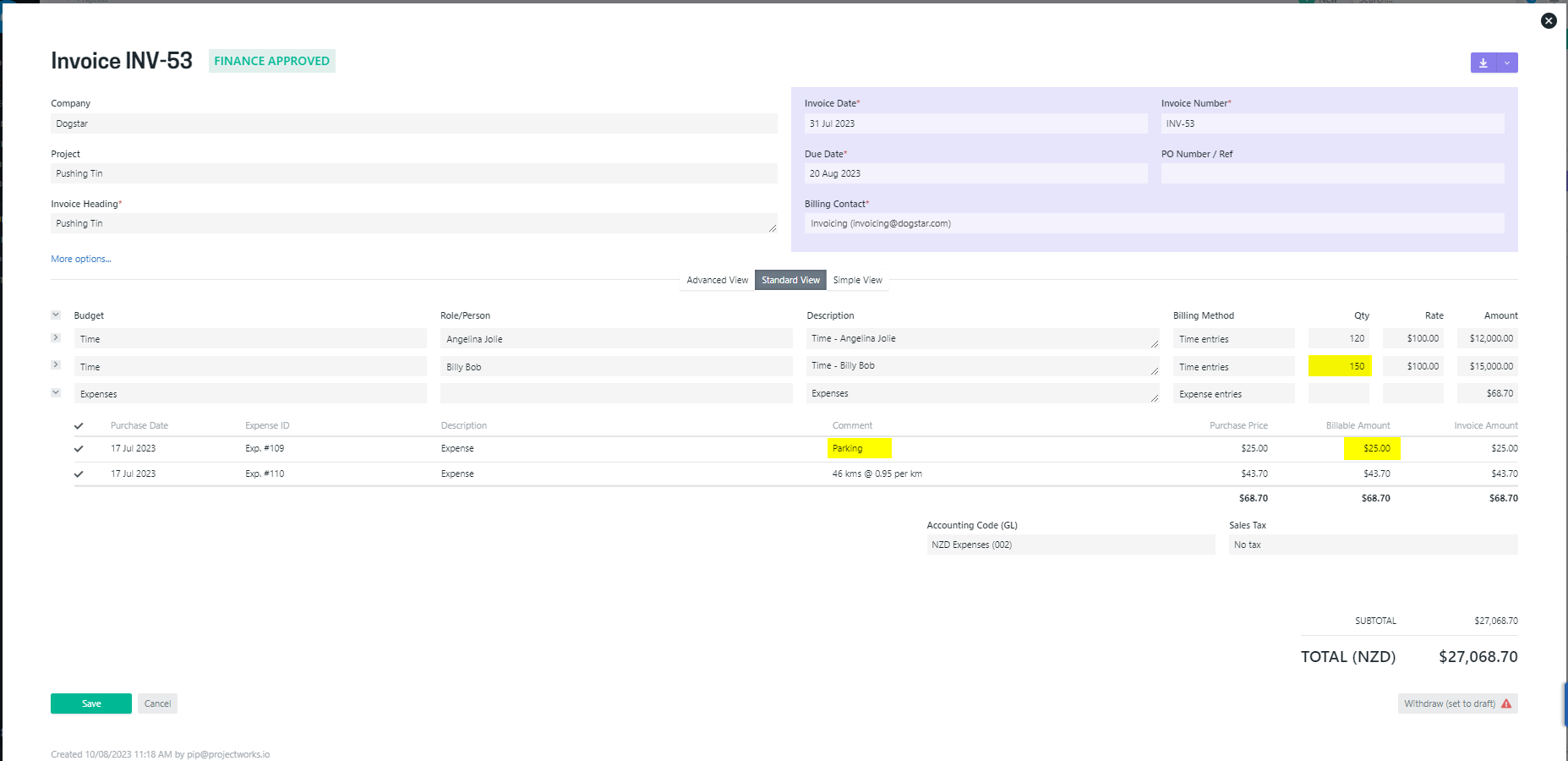

Client 123 is invoiced for three weeks of work on Project A, and this includes:

-

Time = $27,000.00

-

Billy Bob’s 150 hours of work at $100 p.h. = $15,000.00

-

Angie Jolie’s 120 hours of work at $100 p.h. = $12,000.00

-

-

Expenses = $68.70

-

Milage = $43.70

-

Parking = $25.00

-

Client 123 disputes the invoice for $3,025.00:

-

30 hours of Billy Bob’s time = $3,000.00

-

Parking expense = $25.00

Add a credit amount to the existing invoice and re-approve it

-

Withdraw the original invoice to draft (so it can be edited);

-

If the Billing Method for the budget line you are wanting to credit is “Time entries” or Expense entries” update this to “Manual (amount)” or “Manual (qty & rate)”, so that the original invoice amount is retained;

-

Remove the time entries or expenses from the original time budget line that was over-invoiced (this will not change the invoice amount for either invoice lines);

-

Add a new line to the invoice for the budget you are wanting to credit;

-

If you are crediting time, select the time entries that you wish to credit for the new time budget line (read more about why you should associate time entries to a credited time budget →);

-

-

Set the Billing method to “Manual (amount)” or “Manual (qty & rate)”, and enter the negative amount that you want to credit.

-

-

Re-approve the invoice.

-

If you have added a credit for an expense, un-mark the expense from being ”Billable to Customer”.

If you have already exported your invoice to your accounting system, this cannot be re-exported from Projectworks. You will need to update the invoicing in your accounting system to reflect any changes made in an existing exported Projectworks invoice.

Add a credit amount to a new invoice

-

Update original invoice:

-

Withdraw the invoice to draft (so it can be edited);

-

If the Billing Method for the budget line you are wanting to credit is “Time entries” or “Expense entries” update this to “Manual (amount)” or “Manual (qty & rate)”, so that the original invoice amount is retained;

-

-

Remove the time entries or expenses from the original time budget line that was over-invoiced (this will not change the invoice amount for either invoice lines);

-

Re-approve the invoice.

-

-

Create a new invoice:

-

Add a new line to the invoice for the budget you are wanting to credit;

-

If you are crediting a time budget, select the over-invoiced time entries you are wanting to credit;

-

-

Set the Billing method to “Manual (amount)” or “Manual (qty & rate)”, and enter the negative amount that you want to credit;

-

Approve the invoice.

-

-

If you have added a credit for an expense, un-mark the expense from being ”Billable to Customer”.

Create an invoice as a credit note

There is no specific credit note functionality in Projectworks, however a credit can be added as a negative amount in an invoice to reduce the revenue amount associated to a project.

-

Update original invoice:

-

Withdraw the invoice to draft (so it can be edited);

-

If the Billing Method for the budget line you are wanting to credit is “Time entries” or Expense entries” update this to “Manual (amount)”, so that the original invoice amount is retained;

-

-

Remove the over-invoiced time entries or expenses from the original budget line (this will not change the invoice amount for the invoice line);

-

Re-approve the invoice again.

-

-

Create a new invoice:

-

Add the budget you are wanting to credit;

-

Select the over-invoiced time entries you are wanting to credit;

-

Set the Billing method to “Manual (amount)” or “Manual (qty & rate)”, and enter the negative amount (or quantity and negative billing rate) that you want to credit;

-

If you have a credit note template, go to “More options…” and select the correct Invoice Template and Invoice Breakdown Template if applicable.

-

-

Go to “Advanced;

-

Approve the invoice.

-

-

If you have added a credit for an expense, un-mark the expense from being ”Billable to Customer”.

TIP: A specific invoice template and invoice breakdown template may be available for you to use if you create a new invoice as credit note. A Projectworks administrator can set up invoice PDF templates.

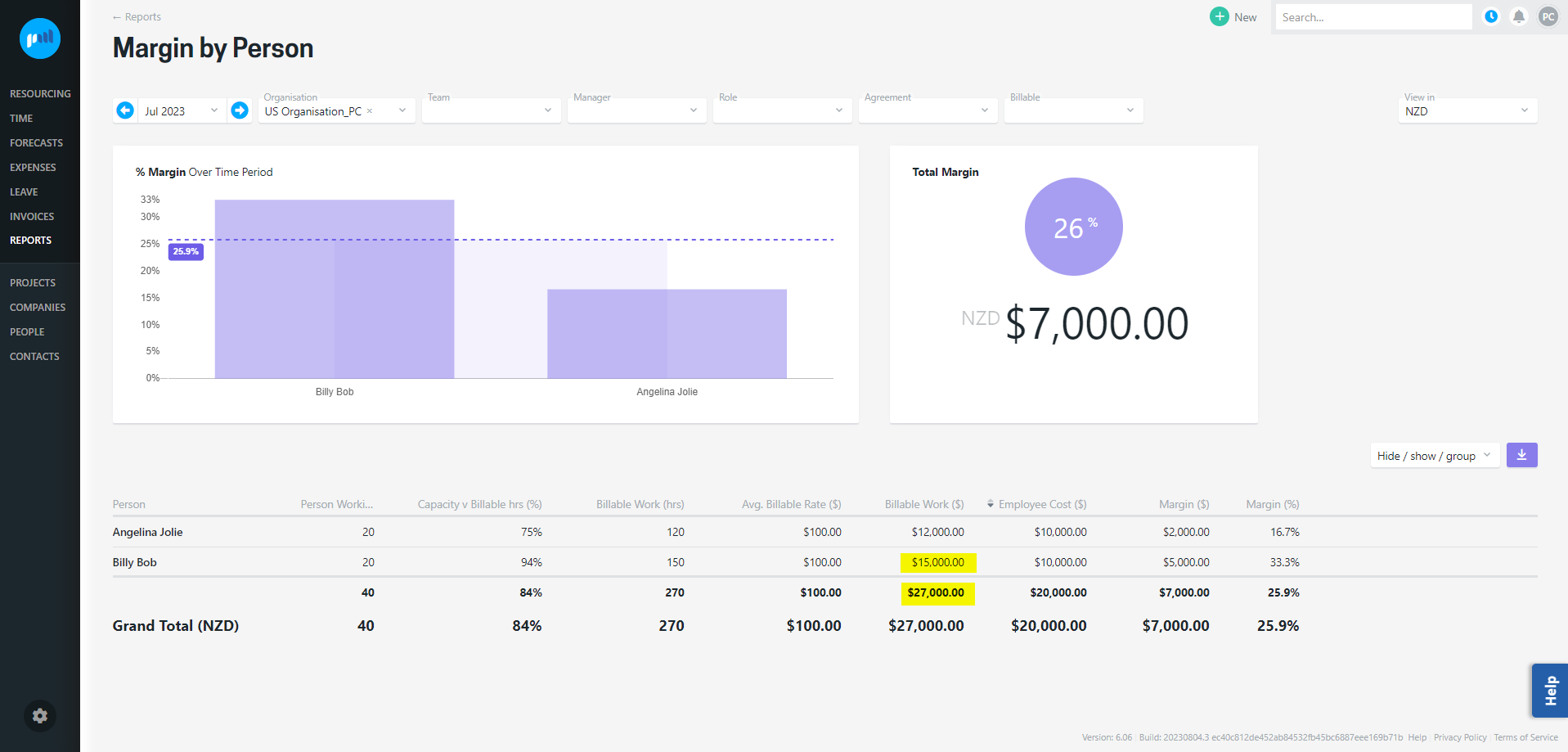

Why do I need to associate time entries to credited amounts?

It is recommended that you associate the credits to the time entries, so that the negative amount off-sets the person’s revenue. Simply adding a negative amount against a time budget will off-set the project revenue, but will not be reflected in against the person.

e.g.

Revenue on time = $24,000.00 ($27,000 - $3,000)

But in the Margin by Person report, Billy Bob’s revenue is reflected as $15,000, and the total revenue on time (Billable Work) = $27,000

Un-mark credited expense from being “Billable to customer“

If you are crediting an expense that has been erroneously invoiced, it is recommended that as well as removing the expense from the invoiced amount, you should un-mark them as “Billable to customer”, so that the expense doesn’t contribute to the project burn. Simply adding a negative amount against an expense budget will off-set the project revenue, but the expense will still contribute to the budget burn.