Time can be adjusted when you are invoicing, so that people’s time entries are invoiced for more or less than the value of billable work. The difference between the invoiced amount and the value of billable work is shown as the “Invoiced Delta”.

Throughout the invoicing process you may want to adjust time up or down for a number of reasons, for example:

-

Invoice all time for a fixed price piece of work, regardless of how long the work took to complete;

-

Invoice for a full days work, even though more or less time was worked (writing-off or writing-on time); or

-

Discount a piece of work, as it has taken longer to deliver than initially quoted (writing-off time);

How to make invoice adjustments on time

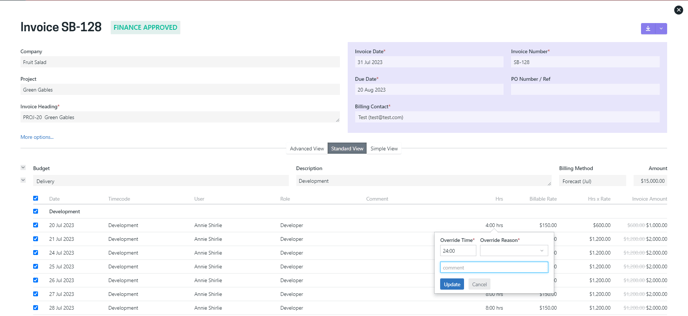

On creation of an invoice, you can adjust the time associated to an invoice budget line by ticking or un-ticking time that has been logged against the project for that invoice line. Time can be adjusted if the invoice is in a draft state.

Time can be carried forward to be invoiced at a later date. Read more about how to carry forward time entries →

There are a number of ways to make an invoice adjustment on a time entry on an invoice:

-

When using a manual billing method, the qty, rate or amount can be edited;

- When using the forecast or a manual billing method, time entries can be ticked or unticked for the budget;

- When using any billing method, the “Hrs” or "Days" for one or more time entries that has been selected can be over-ridden;

If any of these adjustments are made the associated time entries will be pro-rated. This can result in the time entry being written-up or written-down, dependent on the amount being invoiced, and the weighting of the time entry.

If the billing method for a budget line in the invoice is Forecast or Manual, uninvoiced time can also be associated to the invoice line in a manager or finance approved invoice, which will update the invoice adjustment, but retain the revenue amount that has been invoiced.

If the billing method for a budget line in the invoice is Time entries, you cannot adjust the line items of an invoice that has been manager or finance approved.

How to carry forward time entries

In some instances, a client may not be invoiced for work that has been carried out until a later date. When creating an invoice, you can carry forward time entries to invoice at a later date by simply unticking the:

-

invoice budget line; or

-

time entries

that will be carried forward.

Pro-rating invoice adjustments

Adjusting the time associated to a finance approved invoice is especially beneficial when you are doing a fixed price piece of work, and invoicing incrementally.

e.g. A new contract for $100,000 is won:

-

$20,000 to be paid on signing of the contract (August 2023) for the work that will be undertaken through to the end of October.

-

A deposit invoice is raised in August, approved and sent to the Client for $20,000 against the “Delivery” budget.

-

3 hours of the Account Manager’s time (at $150 p.h.) associated to the invoice = $450.

-

Invoiced delta = $19,550 ($20,000 minus $450)

-

-

-

The development team enter 300 hours of time against the “Delivery” budget in September and October (at $100 p.h.) = $30,000 value of billable work

-

The Project Manager retrospectively edits the August deposit invoice (for $20,000) to also include the September and October time.

-

The Account Manager’s time is recalculated to $295.57 ($450 divided by ($450 + $30,000) multiplied by $20,000)

-

Invoiced delta = -$154.43 ($295.57 minus $450)

-

-

The development team’s time calculated to $19,704.43 ($30,000 divided by ($450 + $30,000) multiplied by $20,000)

-

Invoiced delta of -$10,295.57 ($19,704.43 minus $30,000)

-

-

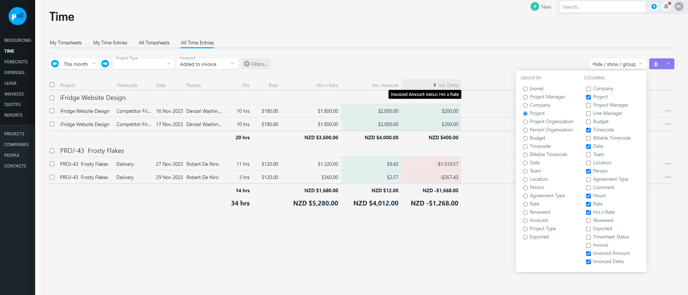

Invoiced Delta

The Invoiced Delta displays the delta between the Invoiced Amount and the value of billable work (Hrs x Rate). The Invoiced Delta is displayed in a number of places, so you can view the write-offs and write-ons on time at a number of levels, e.g. by Project Manager, Person or Project.

Invoiced Delta = invoiced Amount minus Hrs x Rate

You can view the Invoiced Delta on any time entry screen:

-

Time > My Time Entries

-

Time > All Time Entries

-

Person > Time Entries

-

Project > Time Entries

Select the Hide/ show/ group filter and select to view the “Invoiced Delta” column. The All time entries screen gives you the ability to see all time entries, and group these time entries in a number of ways to give you access to the invoiced delta at a person, project or organisation level.

You can also download a CSV, so that you can more easily interrogate the data.

Troubleshooting

The total is not shown

If the grouping you are viewing the time entries for includes invoiced amounts in various currencies, the values cannot be shown on the screen. Hover over the “Total Not Shown” to view a breakdown of the values.

The time entries are displayed in the incorrect unit (e.g. hrs instead of days)

When you create an invoice, the time entries will be displayed in the unit of time that your project invoicing setting is saved to.

Read more about invoicing with day rates →

I cannot override a time entry to more than 24 hours

As there are 24 hours to a day, you can only override a time entry’s time to a maximum of 24. If you enter a greater amount than 24, the Override Time will automatically revert to 24.

If your project invoicing setting is set to days, the maximum days will be 24 DIVIDED BY Default hours per day on rate cards

Read more about how to set up invoicing with day rates →

The overridden time entry is displaying an odd amount

Much like timesheet entries, overridden time can be entered in hours or minutes i.e.:

-

If you enter an amount in hours, with a decimal place, this will calculate to hours and minutes, e.g. 1.30 = 1 hour 18 minutes

-

But if you enter an amount in minutes with a colon, this will remain as hours and minutes. e.g. 1:30 = 1 hour 30 minutes

If the project invoicing setting units are set to “days”, then the hours and minutes will be converted to a day quantity. e.g. If the Default hours per day on rate cards is set to 8 hours, and the time entry is overridden to 1 hour and 18 minutes, then the day rate will be displayed as: 0.1625 days (78 minutes DIVIDED BY (8 x 60 minutes))

Overridden time cannot be entered in days, even if the invoicing units are set to days.